Back Main Street Member

Become one of the most highly respected, valuable and successful entrepreneurs in your community.

Eliminate Hidden Profit Leaks

Members help each other identify and remove unnecessary costs — from processing fees to overpriced vendor contracts — keeping more money circulating locally.

Turn Everyday Transactions into Assets

Instead of letting banks and big processors keep the profits, members use shared payment systems that generate passive income for the network.

Circulate Wealth Within the Community

Members intentionally buy, sell, and refer within the Back Main Street network, ensuring money changes hands multiple times locally before leaving.

Share Tools, Knowledge, and Opportunities

From cash flow health checks to funding connections, members give each other access to resources that big corporations keep behind closed doors.

Collaborate on Local Growth Campaigns

Members team up on marketing, events, and promotions that draw customers to Main Street businesses rather than sending them to national chains.

Optimize Health to Fuel Wealth

Members treat energy like an asset — prioritizing nutrition, movement, and recovery to sharpen focus, cut downtime, and make stronger cash-flow decisions.

90% of Small Business Owners Can't Get A Loan from A Bank Which Is Bad News for Main Street

Fuel Household & Community Wealth by Backing Our Small Business Profit Share Support Services

Our goal is simple: To educate small business owners and community members on how Main Street entrepreneurs can access credit card processing fee avoidance and growth and rescue capital using a decentralized strategy that can pay for itself — and even generate passive income for both the owner and local households which eliminates most of their risk when it comes to credit card processing and leveraging debt. It’s something traditional banks won’t dare to offer… And predatory lenders don’t want you to know exists. Back Main Street™ is a cooperative movement helping small business owners, households, and communities generate and circulate cash flow — together.

Attention Small Business Owners and Community Members!

This is the age of a decentralized sharing economy — where platforms like Airbnb and Uber have shown how everyday people can bypass the system, and now it's Main Street's turn to take back control. So our Support for Co-op Decentralized Small Business Payment Processing and Funding reveals a simple way to financially protect your household income and improve it — by backing us with protecting local business owners and shielding our local economy from the rising cost of living—and the growing influence of centralized banking, corporate and government control that can limit our liberty and freedoms.

Are you concerned about inflation, lower profit margins, or rising food and housing costs and poverty affecting you and the people in your community? If we’re serious about economic power, the real move is building a Main Street small business lending network that puts the people and small business owners in control — and not the banks and politicians. Just like America needs to break its over-dependence on China, Main Street needs to break its over-dependence on bloated banks, chain stores and broken government — all riddled with greed, waste, fraud, and abuse.

Do you know about 80% of our small businesses are suffering in silence by being denied for loans from traditional banks, which leads to them being financially squeezed out by Wall Street-backed chain store competitors and government—even when they’re profitable?

Our Founding Fathers warned us about this. Thomas Jefferson once said, "If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks will deprive the people of all property." Today, we’re living the consequences through Main Street being cash flow constrained by traditional banking and predatory lenders.

The Federal Reserve isn't federal—and it doesn't reserve anything for the average American. Central banking has quietly siphoned power from the people by driving up costs and starving local businesses of opportunity by maintaining a 2% instead of a 0% inflation target for no good reason, which is nothing more than a hidden tax stealing wealth from the average American household—an institutional tool to preserve Wall Street’s advantage over Main Street.

Think of it like this: imagine your neighbor had a hose secretly hooked up to your water line, slowly draining it day after day. You barely notice at first—but over time, your water pressure drops, your garden withers, and your bill goes up. That’s what the 2% inflation target does. It quietly pulls wealth from Main Street and funnels it to Wall Street under the guise of stability, which leads to things like tariff wars, needing to increase the debt ceiling and printing money that's destroying the value of the US. Dollar.

If you are worried or even just concerned, this may be the most important local campaign you’ll hear about this year.

Just like Airbnb gave everyday people a way to bypass the hotel industry and take back control, the Back Main Street Movement is doing the same for payment processing and business funding. We’ve built a decentralized processing and funding network that helps small business owners skip the banks processing fees, avoid the red tape, and access fast, flexible capital — without sacrificing profits and risking their home or being judged by their credit score. It’s not just processing and funding — it’s financial freedom, owned and powered by Main Street, not Wall Street.

Join us in putting financial power back in the hands of Main Street—because when payment processing and funding for small businesses stays local and decentralized in this day and age, so does prosperity and independence.

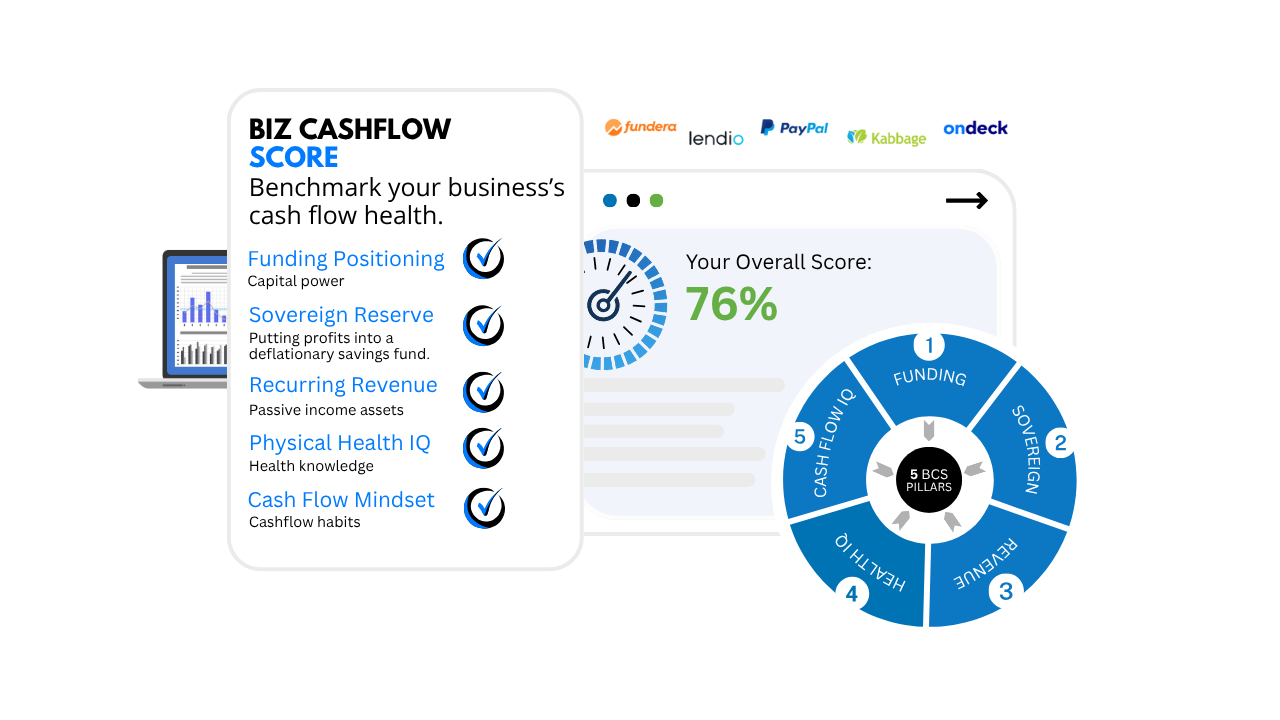

Discover Your Cash Flow Health Score

Keep more profit, cut leaks, and build financial security — fast.

Get Your Cash Flow Score Instantly

Be Part of the New Back Main Street Movement

Whether you're a local business owner or just someone who believes in the power of Main Street, you can help uplift our economy from the bottom up just by displaying one of our signs at your place of business or residence to support our mission of elevating the financial well-being of our local small business owners, household's and community.

Latest Back Main Street Backers

- ✅ Helen's Spa – Norton, MA

- ✅ Luka B. Signs – Taunton, MA

- ✅ Hairitage The Salon – Taunton, MA

- ✅ Zack's Pizza – Randolph, MA

- ✅ American Auto Sales – Bristol, CT

- ✅ Aziz Tires – Taunton, MA

- ✅ Cutting Edge Barbershop – Taunton, MA

- ✅ Travis Cycle – Taunton, MA

Ready to boost your Cash Flow IQ?

Click below to unlock the Back Main Street' Ultimate Cash Flow Guide.

COMING SOON: Back Main Street™ Show Your Household and Local Community Support Collection

Wear It. Share It. Fund the Movement. Order on Amazon soon.

Disclaimer: Back Main Street and its affiliated partners are not banks or direct lenders. We provide access to alternative funding options through independent providers. All funding is subject to approval and terms set by third-party lenders. This is not a guarantee of funding. Always consult with a qualified financial advisor before making financial decisions.